| GST Registration |

Requirements, Process, & Expert Assistance

Since its introduction on 1 July 2017, the Goods & Services Tax (GST) has been mandatory for all service providers, traders, manufacturers, and even freelancers in India. The GST system was implemented to replace Central and state-level taxes such as Service Tax, Excise Duty, CST, Entertainment Tax, Luxury Tax, and VAT, making the tax process more streamlined. The GST registration charges vary depending on the type of business and turnover.

Key Components of GST Registration

The Goods and Services Tax (GST) in India is structured around three primary components:

Integrated Goods and Services Tax (IGST): This tax is imposed by the Central Government on the supply of goods and services that occur between different states or between a state and a Union Territory. IGST is relevant for transactions where goods or services cross state or Union Territory boundaries.

Central Goods and Services Tax (CGST): This tax is levied by the Central Government on the supply of goods and services within a particular state. CGST applies to transactions carried out entirely within the boundaries of one state.

State Goods and Services Tax (SGST): SGST is charged by the State Government on the supply of goods and services within its jurisdiction. Similar to CGST, SGST is also limited to transactions happening within a specific state.

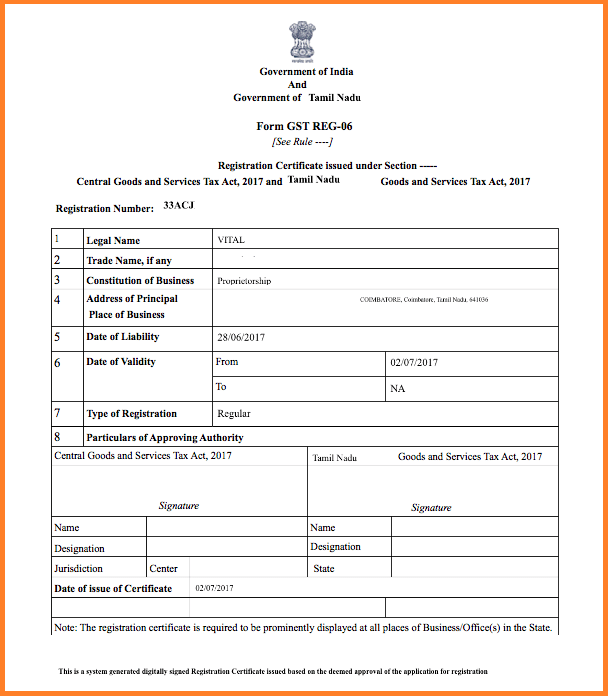

GST Certificate (Sample)

| GST Registration-Required Documents |

| Sole proprietor / Individual | PAN card of the owner Aadhar card of the owner Photograph of the owner (in JPEG format, maximum size 100 KB) Bank account details* Address proof** |

| LLP and Partnership Firms | PAN card of all partners (including managing partner and authorized signatory) Copy of partnership deed Photograph of all partners and authorised signatories (in JPEG format, maximum size 100 KB) Address proof of partners (Passport, driving license, Voters identity card, Aadhar card etc.) Aadhar card of authorised signatory Proof of appointment of authorized signatory In the case of LLP, registration certificate / Board resolution of LLP Bank account details* Address proof of principal place of business |

| HUF | PAN card of HUF PAN card and Aadhar card of Karta Photograph of the owner (in JPEG format, maximum size 100 KB) Bank account details Address proof of principal place of business |

| Company (Public and Private) (Indian and foreign) | PAN card of the Company Certificate of incorporation given by Ministry of Corporate Affairs Memorandum of Association / Articles of Association PAN card and Aadhar card of authorized signatory. The authorised signatory must be an Indian, even in case of foreign companies/branch registration PAN card and address proof of all directors of the Company Photograph of all directors and authorised signatory (in JPEG format, maximum size 100 KB) Board resolution appointing authorised signatory / Any other proof of appointment of authorised signatory (in JPEG format / PDF format, maximum size 100 KB) Bank account details Address proof of principal place of business |